Memorabilia Is Going Digital on the Blockchain

NFTs—non-fungible tokens—provide a way to create digital scarcity and verifiable ownership. Fans can buy and sell digital collectibles like art and music. The technology is even coming to the sports industry, with Dapper Labs being the first to market with NBA Top Shot.

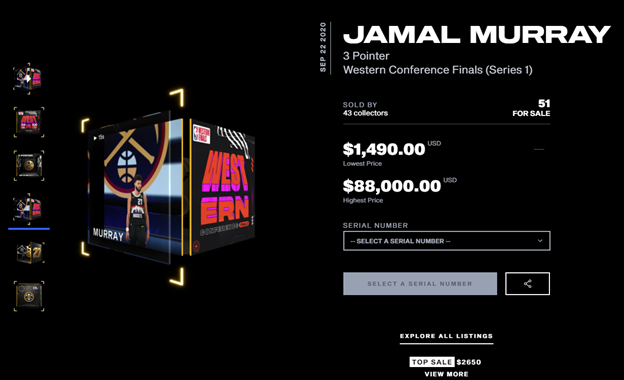

In partnership with the NBA and NBPA, NBA Top Shot sells game moments and creates a marketplace for them using NFTs. Imagine a trading card, but with a few seconds of video featuring a game highlight. Each “moment” has a serial number and a limited quantity available. Lucky fans who get in on the opportunity can buy a “moment pack” at the base price of $9 or premium packs with enhanced moments at higher prices. They’ve already generated over $230 million in sales while still in beta!

Next comes electronic dance music producer 3LAU. Last weekend, he auctioned the world’s first digital tokenized album. Fans bid on 33 NFTs, each of which provides access to the album “Ultraviolet” online and can be redeemed for unreleased music and unique experiences. The auction hauled in over $11 million and demonstrates one way musicians may be able to recoup losses caused by the pandemic.

The visual artist Beeple is also using NFTs to auction artwork online. A collector bought a 10-second video clip for $67,000 in October 2020, then recently auctioned it for $6.6 million—all despite the fact that anyone can watch it online for free! The original purchaser compared the NFT artwork as being like an original painting: anyone can take a photo of the Mona Lisa, but only the original has value to a collector. Even the famous auction house Christie’s is getting in on the action: another work by Beeple is currently on the block with a top bid of $3 million at the time of this post.

Why Does This Matter?

These are some staggering dollar figures, but what’s the point of digital collectibles when you can’t put them on display or touch them?

- Blockchain technology can prove the art is authentic and verify the ownership history.

- There’s no risk of damage compared to physical memorabilia, and only minimal risk of theft.

- Gen-Z grew up in the digital space and will likely be the largest consumer spending group by 2026.

- There’s a market opportunity for digital frames that allow owners to display their NFTs.

Ultimately, NFT-based digital collectibles have value for the same reason that physical collectibles do: supply and demand. After all, it’s easy to get a replica of the famous T206 Honus Wagner baseball card so why would anyone spend hundreds of thousands on an original? There’s a story behind the scarcity that drives collectability, whether it’s physical or digital.

Bring in the Sponsors

NFTs could quickly become a new sponsorship asset for sports and entertainment organizations. For example, a digital ticket Presenting Sponsor might let fans redeem tickets after the game for an NFT representing a highlight from that very game. We could potentially see a whole new class of memorabilia where fans could own a moment of the game they attended. Imagine redeeming your digital ticket and getting a limited-edition video clip of the game-winning touchdown of a Bears vs Packers game!

Of course, that’s only one possibility. Which sports team will be first to market with NFT game giveaways? NBA Top Shot is proof that fans will take interest if the product gets it right.