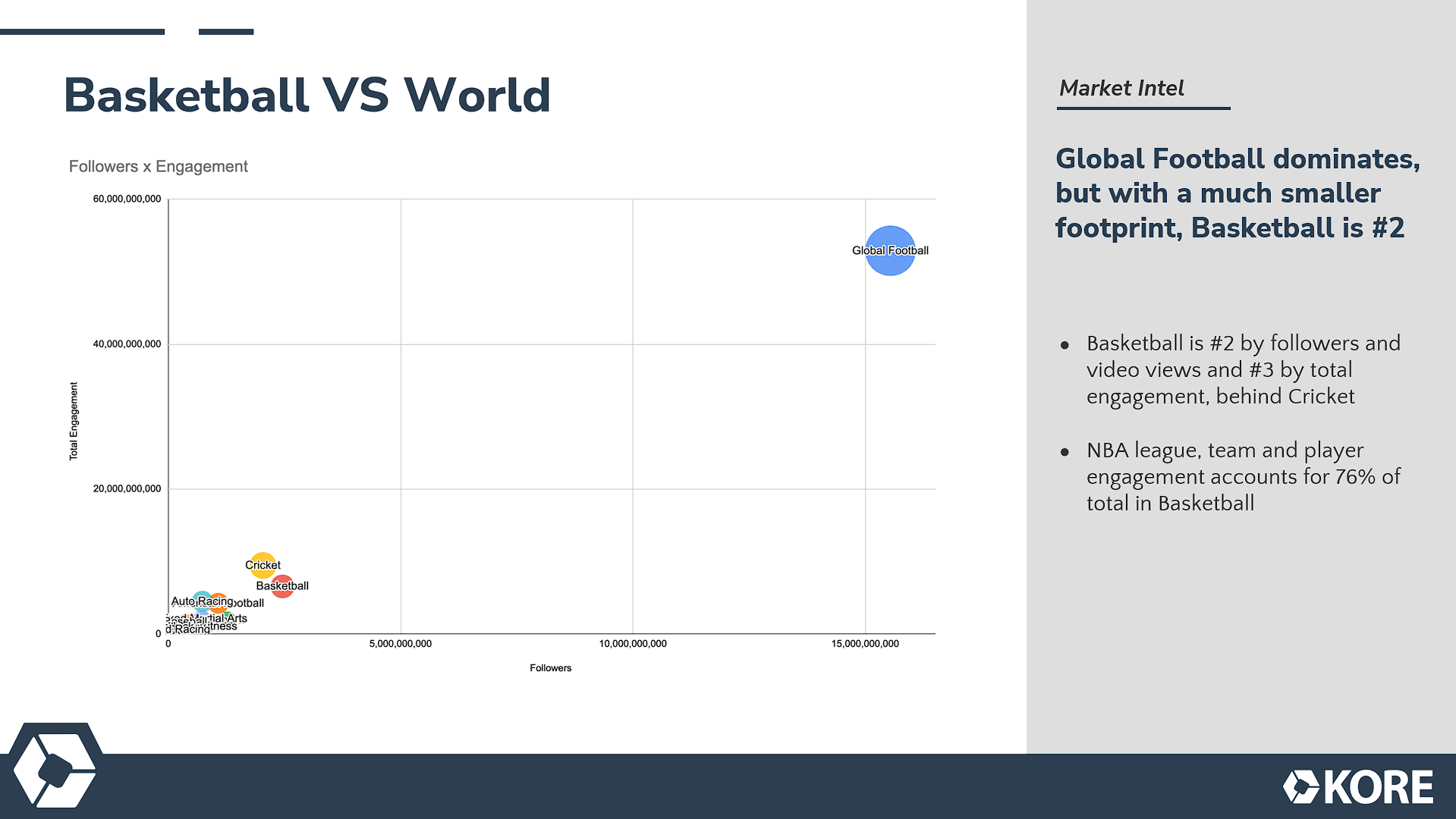

While global football is generally in its own universe when it comes to world-wide fandom, the NBA is in a league of its own regarding social video viewership across the world of sport.

Basketball is the second most engaged sport, globally, on social media and the NBA and its teams, and the players create 76% of that engagement. Here, we walk you through highlights of buzzworthy insights from our recent NBA mid-season market intel workshops, where brands and teams learn trends, and tactics they can immediately implement into their partnership strategies.

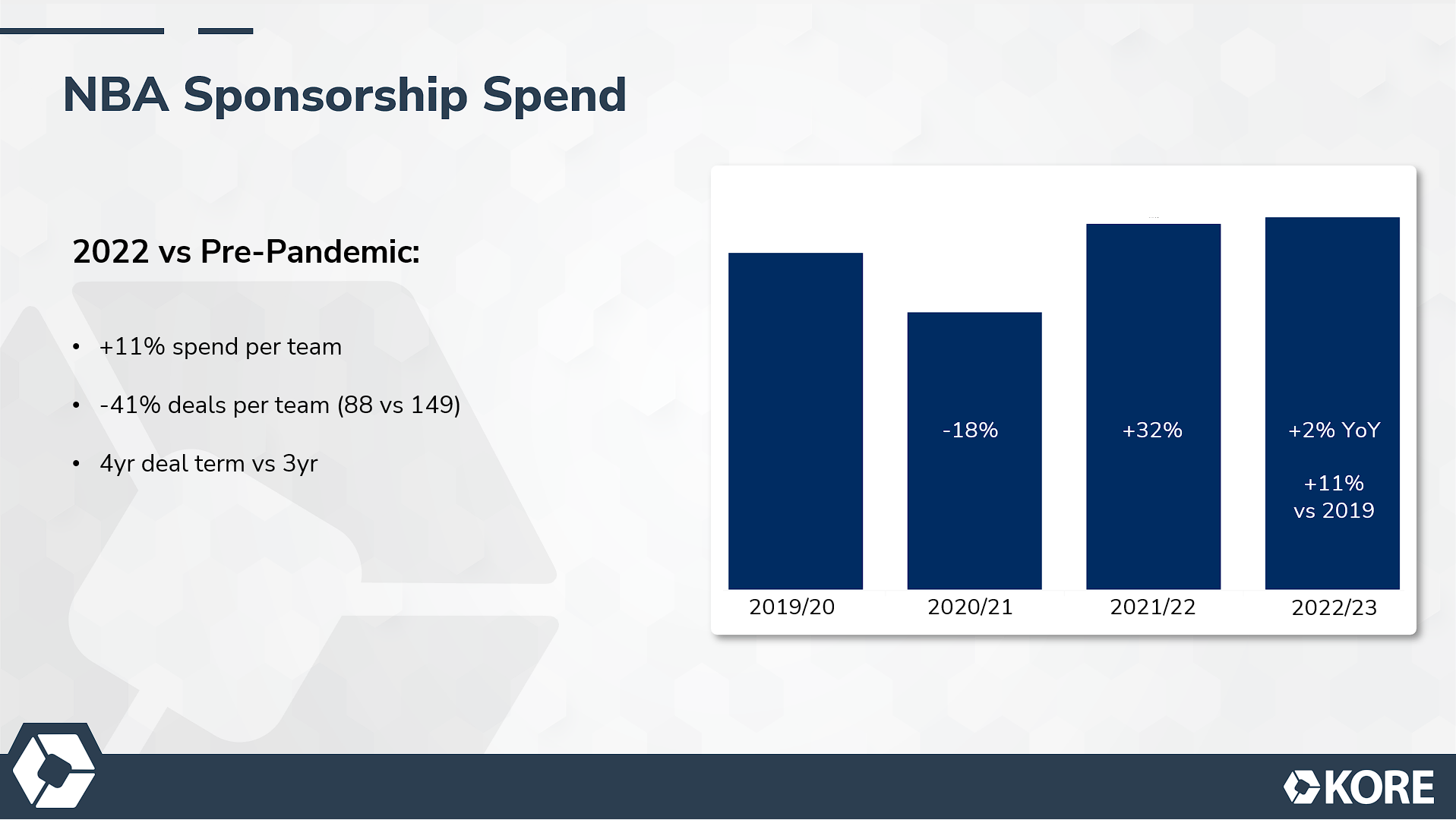

Trend: Spend is up with fewer deals

Sponsorship spend in the NBA bounced back big in 2021. With moderate growth YoY, but solid growth vs Pre-Pandemic, brands are focusing on the right partnerships, doing fewer deals but signing longer terms with larger annual spend. This aligns with the data we’ve seen across all sectors which we go into deeper in our annual State of the Industry, a 2022-2023 data-driven review of sports marketing and sponsorship spend trends.

This spending trend means that rather than spreading their budgets thinly across multiple partnerships, brands are doubling down on their high-performing relationships. This not only ensures a higher ROI but also strengthens the partnerships by allowing brands to better understand what makes them successful. When partners get clear on what the objectives of the partnership are, they can work together more effectively toward the common goal. Follow our tips on how to ask your partners what their objectives are, in order to measure progress.

Based on the sponsorship spending trends, choosing the right partnerships is more critical than ever. Here are 4 essential steps to selecting the right partnerships.

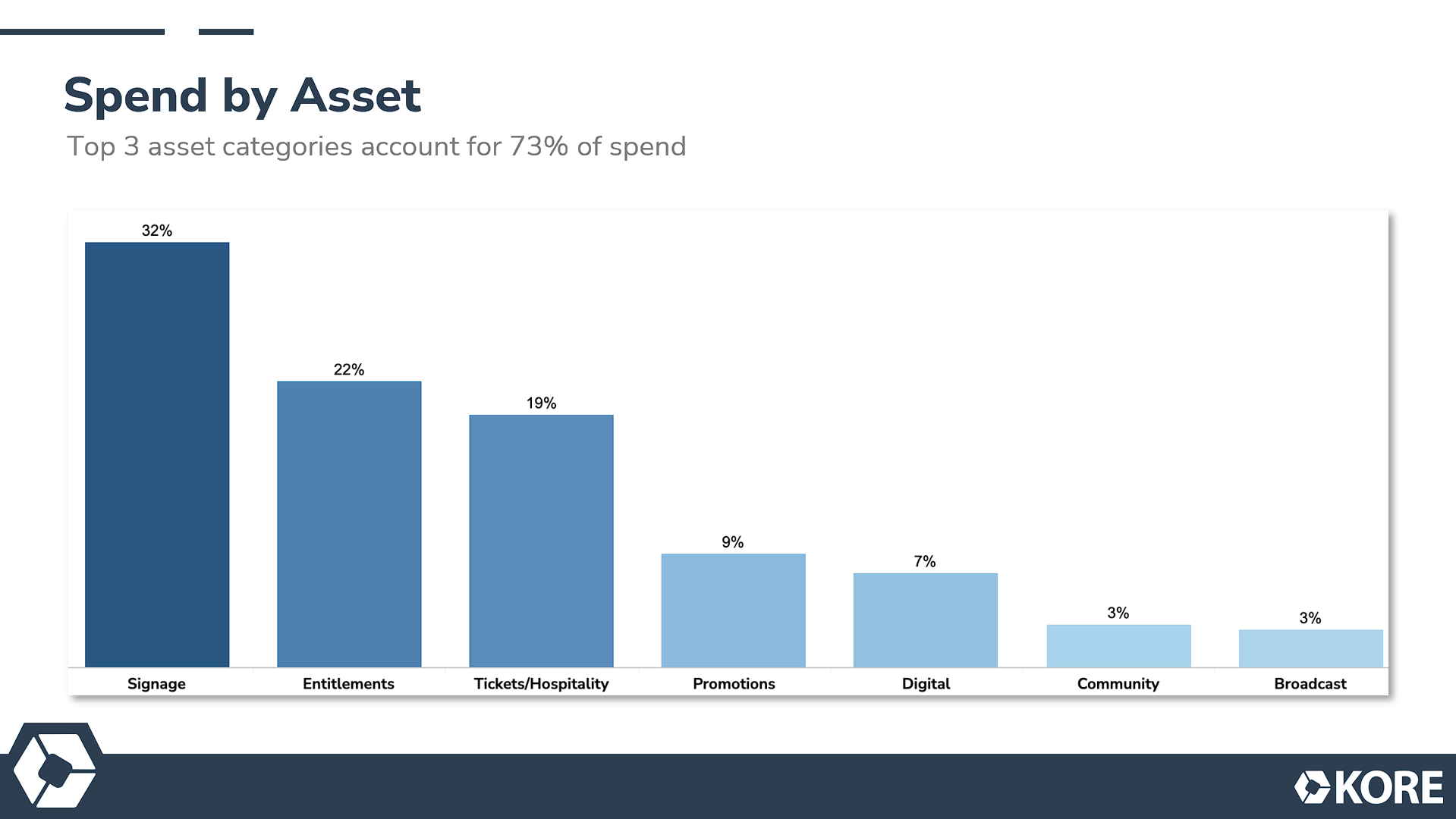

Top assets in NBA partnership contracts

The top assets used in partnership deals is consistent with global trends. Across all North American big leagues, signage and tickets & hospitality are the most frequently utilized assets, occupying either the number one or two spot in each league. Interestingly, despite its growing importance in the marketing world, digital accounts for just 7% of the total spend on assets. However, it’s written into 46% of all partnership contracts, which is just slightly less than entitlements, which are included in 47% of basketball partnership deals. This could suggest that digital assets are relatively affordable and underutilized in comparison to other assets.

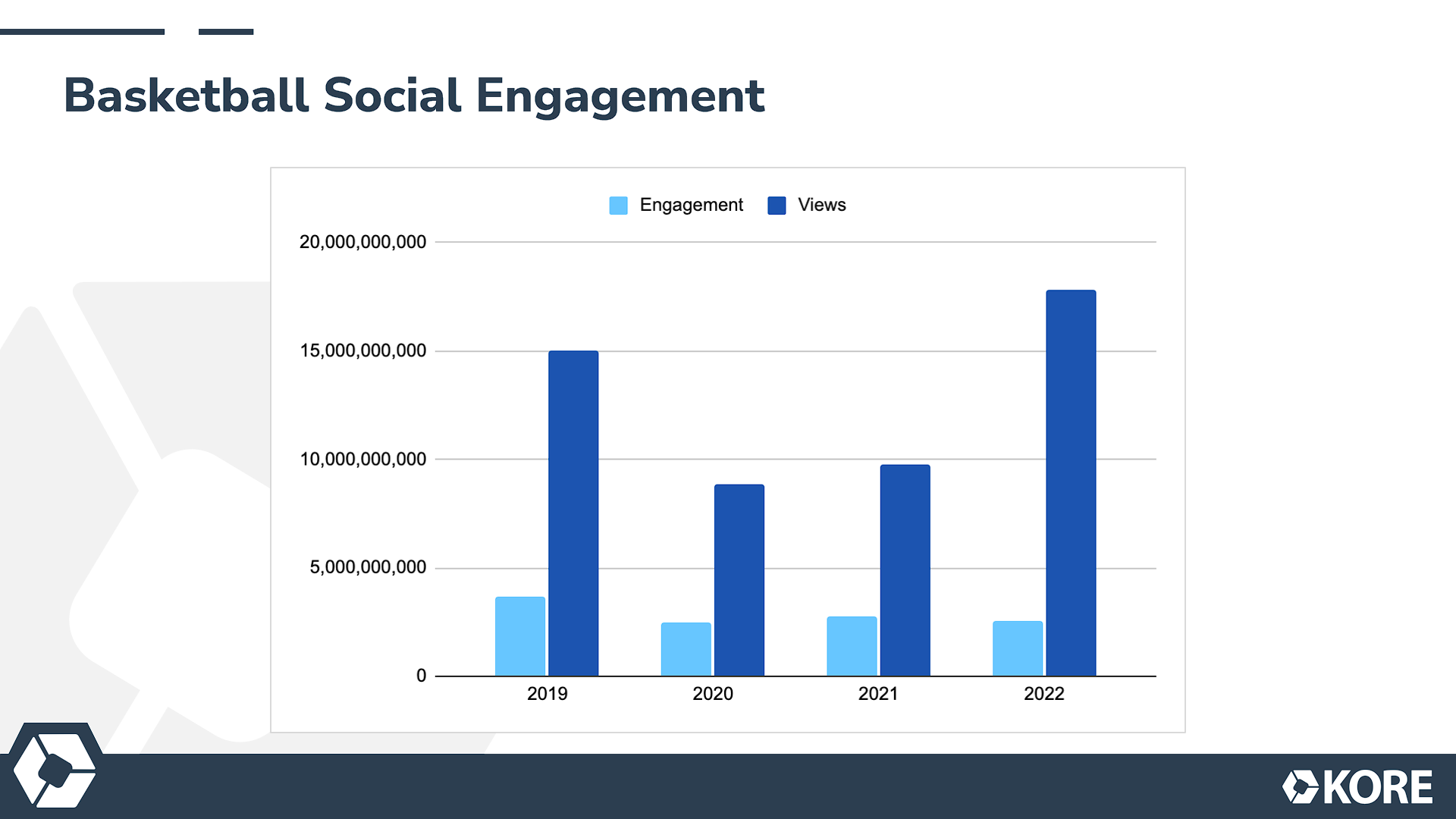

Social Trend: Engagement slightly down, views up

Social media drives significant exposure and value for brands with the added benefit of near real-time measurement & optimization.

The 2022/23 season to date is seeing a 7.6% decrease in engagement vs the same time last season, but an 82% increase in video viewership – both trends are fueled largely by the push to short video from the platforms, and fans. This is where the NBA dominates.

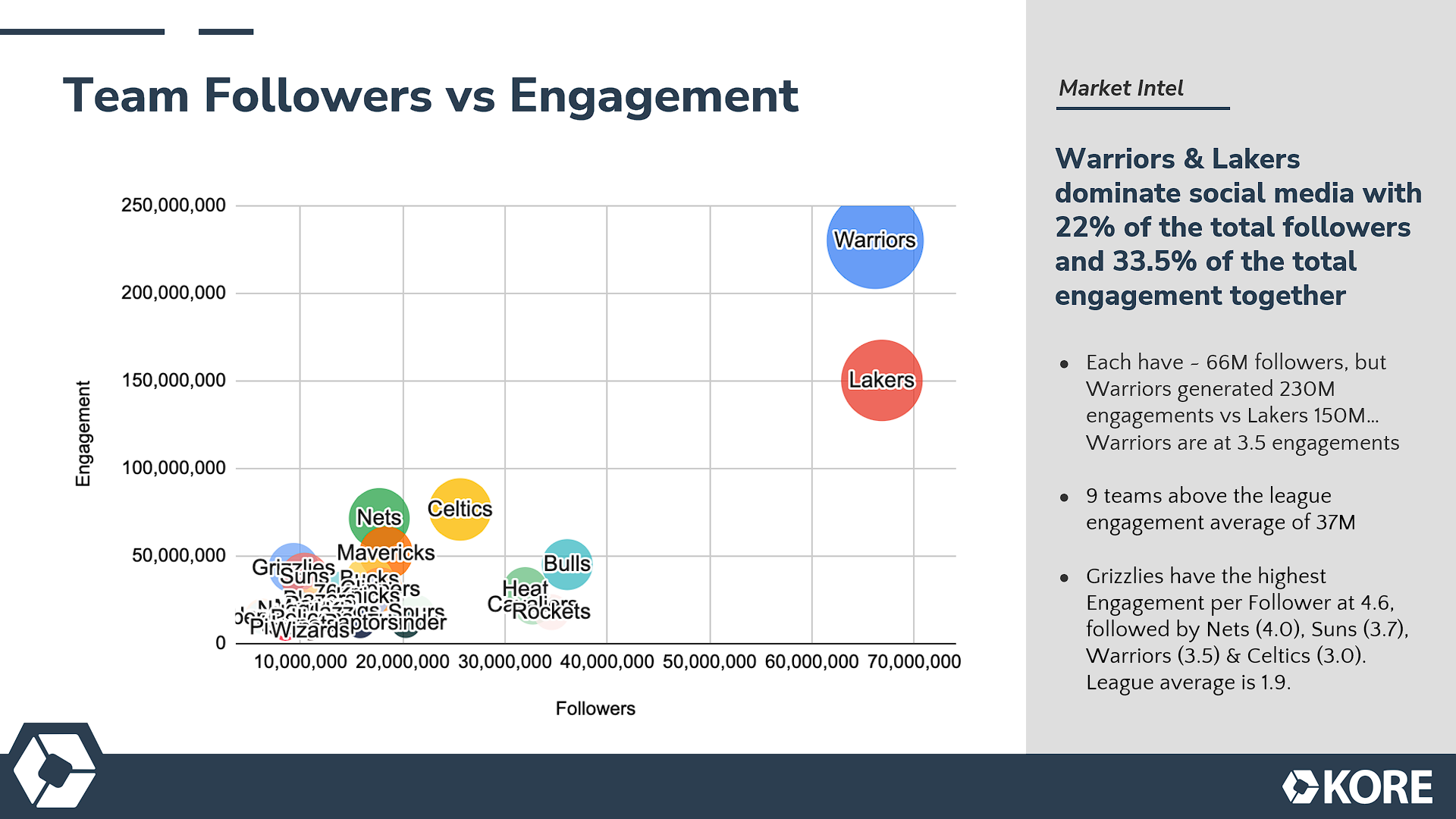

Social leaders: Warriors & Lakers

The Warriors and the Lakers alone drive more than 1/3 of the total amount of engagement in the NBA and have 22% of the total followers amongst all NBA teams.

- The two teams have 66 million followers, but Golden State generated 230 million engagements so far this season versus the Laker’s 150 million

- Nine teams are above the average of 37 million followers

In terms of loyal fans interacting the most, the Memphis Grizzlies have the highest engagement per follower at 4.6. Close behind are the Nets with 4.0, the Suns with 3.7, the Warriors at 3.5, and the Boston Celtics with 3.0 engagements per follower. The average across the league is 1.9.

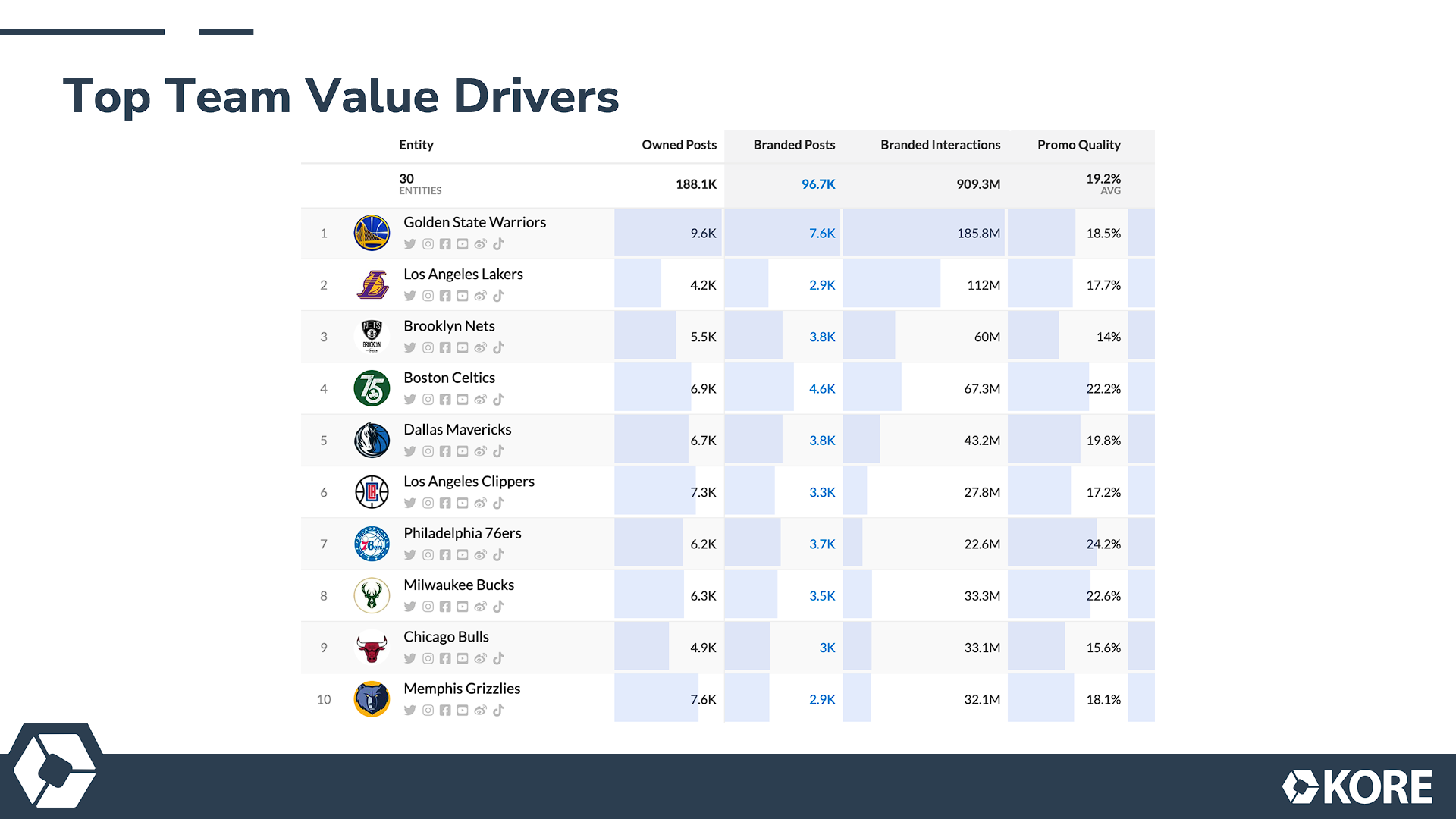

Ranking of top 10 team value drivers

Golden State Warriors drive 21% of all brand value from team owned accounts

- Warriors have most total posts, most branded posts and most branded interactions

- Nets have the highest value per follower ($5.9K)

- Wizards (ranked 27 by AAV) have the highest average promotion quality (32.2%)

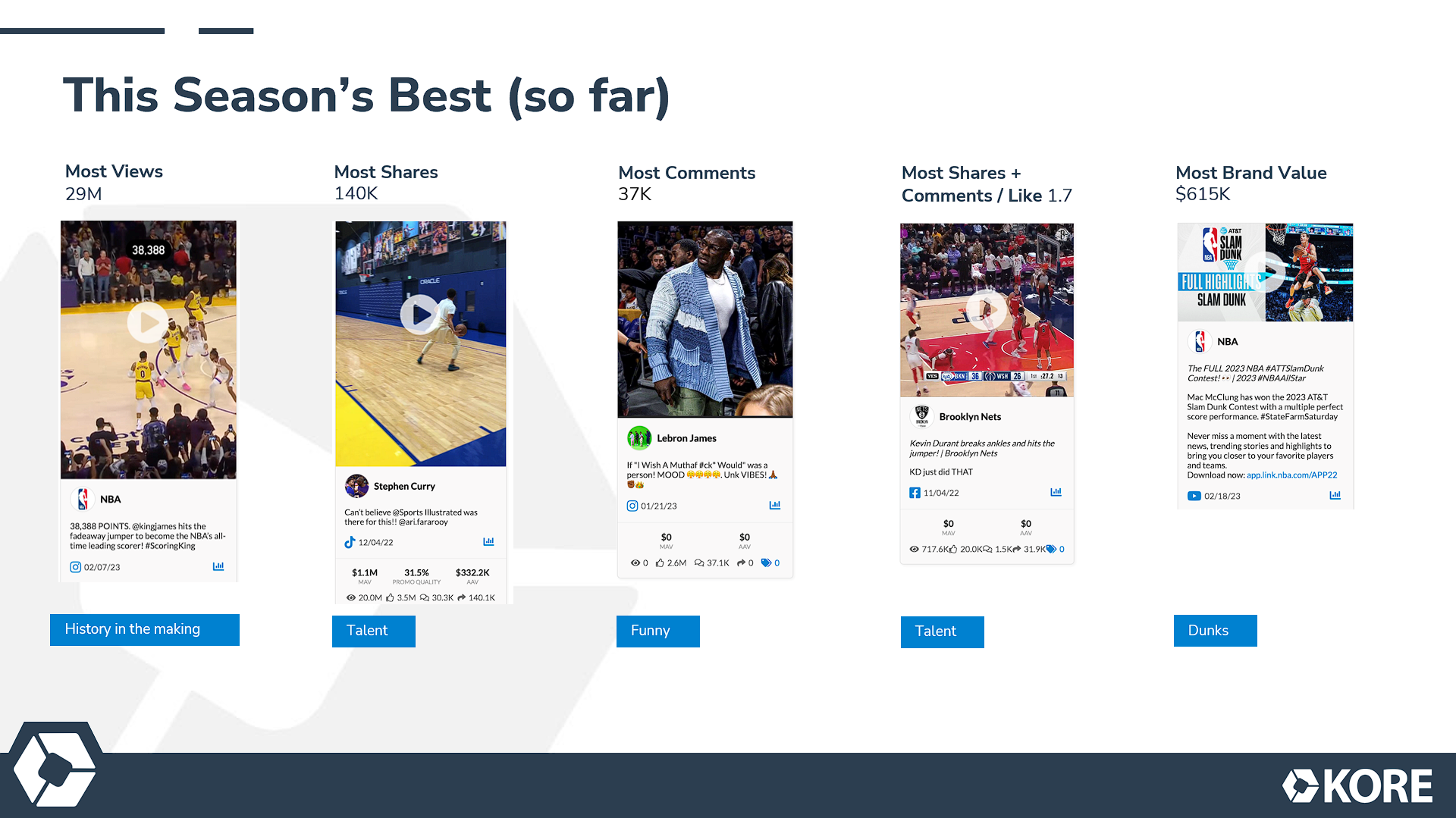

Top campaigns, activations & posts across the NBA 22/23 season, so far

The posts that work the best are behind the scenes, fan interactions, heartwarming, funny, or raw display of talent and history in the making. To learn:

- Which posts went the most viral

- Which athletes are driving the most value for brands

- Which brands are getting the most value through athletes, teams and from which platforms

Simply request the full report to review.

Below are explainers on what goes into KORE’s evaluation, what we analyzed and the type of data and insights you can garner from it.

Understand KORE’s evaluation model

Our deep-data analysis tools are designed to help you identify the best opportunities for investment and growth in the sports industry. The insights provided helps brands identify areas of value and uncover the best opportunities for investment and growth. They can also help you decide which assets to invest in and see how your industry, brand or team stacks up against the industry’s richest dataset available.

Adjusted Ad Value (AAV) for Measurement

The Adjusted Ad Value (AAV) formula assigns a dollar value to a social post based on how clearly logos or brand mentions are displayed within text, image, or video and how much engagement the post generates. Features include:

- Text-only social listening tools miss significant visual attribution.

- Evaluate Social, designed by Hookit, can capture a brand’s social value through:

- Quality logo visibility

- Audience data and watch-through rates

- Built-in authentication + more

These features create a robust data story. We can track the AAV of any content created on social media that displays clear logos, deliberate tags, and keyword mentions.

How Was the NBA Mid-Season Report Analyzed?

Sponsorship spend data from the majority of NBA teams against 16 sectors.

- 250k+ social media posts from the league, teams, and players from October 1, 2022 to March 15, 2023.

- Social media data includes followers, posts, engagement, valuation & audience data.

- Platforms include Facebook, Instagram, TikTok, Twitter, YouTube, Weibo and VK.

About KORE Market Intel Reports

KORE, acquired Hookit, an innovative AI-powered sponsorship analytics and valuation platform in February 2022. This acquisition is transforming the way brands and rights holders manage, measure, and optimize their partnerships together. By integrating Hookit’s data and analytics into KORE’s Portfolio Optimization Platform, specifically its Evaluate Social tool, both sides of the sponsorship can gain unparalleled insights into the performance of their partnerships and make quick adjustments to their strategies.

If you’re looking to examine your 2023 partnerships with strategic insights & impactful data, then please contact our team. We’re happy to share the full NBA mid-season report, deeper insights, or take a look at any other sport season, group, or event. With a full report or presentation, you can:

- Learn what kind of impact the sport, leagues, events, and athletes have on fan engagement and why that matters

- Find inspiration for partnership concepts

- See how industry experts and peers are tracking impactful data and insights that help you measure return on objectives (ROO) or even return on investment (ROI)

- Gain strategic and tactical actions you can implement right away