‘Tis the season, and by season we are of course referring to the season of March. To the outside world this might be considered just like any month, but in the sports & entertainment space March is one of the most exciting times of the year. Recent news includes Tom Brady un-retiring, Major League Baseball starting spring training, and why we are gathered here today, the 2022 Men’s & Women’s March Madness basketball tournaments.

Last year, we created a bracket to visualize the types of sponsorship assets that get sold into college sports deals. Radio assets won by a landslide, being included in 40% of deals. This does not necessarily mean radio is a massive revenue generator for these schools, but it is both an efficient asset to include in deals and reaches the college athletics audience consistently.

The data we are exploring is at the school level, separate from deals directly with the NCAA. Wendy’s, for example, is an NCAA sponsor, meaning the partnership details involving the surplus of Reggie Miller commercials the rest of the month are not being counted in our bracket, as that deal is directly with the governing body.

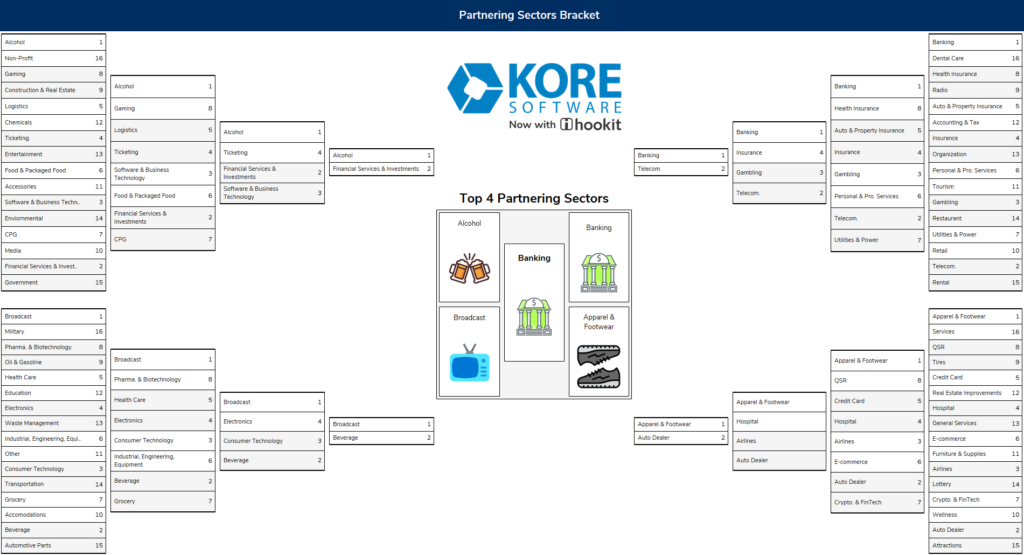

This year we parsed through KORE Software’s industry-leading data set to uncover which sectors tend to engage in college sponsorship deals. In the data, we identified 16 sectors with over 60 sub-sectors (to date) making up those sectors. For example, Quick Service Restaurants (QSRs) fall under the “Food & Beverage” sector and are pushing their marketing dollars towards college athletics.

Food & Beverage as a sector would contain sub-sectors like alcohol brands, packaged food, QSR, grocery brands, and more. This list is ever-evolving, especially as new types of companies enter the sponsorship space. In the Financial sector, for example, Cryptocurrency & FinTech were only recently added to our watch list. Previously they could have fallen under a Banking or Financial Services sub-sectors until the explosion of brands entering the space.

To organize the bracket, sub-sectors were ranked and separated into “regions” based on their overall spend towards college athletics. Given this is not quite a competition and more of a visualization, the “higher ranked” sub-sectors automatically moved onto the next round to eventually show us the sub-sectors spending the most on college sponsorships.

Looking at sports sponsorship from a global landscape the sectors consistently out-spending competition are Food & Beverage, Financial, Communications & Media, and Retail. Some of the largest brands in the world encompass these sectors, such as Pepsi, JPMorgan Chase, Verizon, Nike, and more. We can use this knowledge as a baseline to predict a spending trend in the college space.

Let’s look at the data

The four semi-finalists were brands in the alcohol, broadcasting, banking, and apparel & footwear sub-sectors, with banking taking the top spot. As banking brands engage in the space, they tend to focus their dollars on entitlement assets (“official” banking partners) meanwhile they include tickets & hospitality assets most often in their deals. These assets offer brands an opportunity to feel part of the school and having an on-campus presence provides a vehicle for recruiting students either as potential employees or customers.

Alcohol finishing in the top four stands out to me but is not surprising, as it is a common sponsor across all entertainment outlets. In college athletics certain industries have a taboo feeling, and alcohol brands fall into that category, especially as many college campuses prohibit alcohol sales and on-site advertising. These restrictions vary by campus, and sometimes even lifted at sporting venues especially around premium areas. Universities still have partnerships with these brands, and with Name, Image, and Likeness (NIL) gaining traction among student-athletes, there is an opportunity for these brands to get creative.

Alcohol and other categories raised as questionable so far have been able to partner with students directly through NIL. Per Front Office Sports “some state NIL laws and school rules allow athletes to do NIL deals with these types of companies, too.” The Alston ruling made it illegal for the governing body to institute strict rules such as prohibiting brands in certain categories, leaving the door open for expanded sponsorships.

New entrants could be prevalent among deals following innovation, both from new products/services and new outlets such as NIL. It is likely we see a shift towards partnerships with more personal messaging especially among NIL deals. According to INFLCR, athletes typically have more social media followers than team or brand accounts. Leveraging a familiar face through digital outlets, brands can promote their messaging in a more personal tone.

KORE is the global leader in engagement marketing solutions, serving more than 200 professional teams and 850+ sports and entertainment properties worldwide, providing practical tools and services to harness customer data, facilitate sponsorship sales and activation, and create actionable insights.