A Look At Current International Sponsorship Trends

As the world continues to come to grips with its new-normal, the sponsorship world is consequently experiencing side effects of new social norms, new engagement activities, and a new appreciation for just how much both sport, and brands in general, play a role in broader society.

We are beginning to see certain reactions and responses gain traction and widespread adoption which, in turn, are forming an array of trends.

Although geographically separate, there is a growing number of trends that we are beginning to see mirror one another across APAC, North America, UK, and Europe.

UK & Europe

1. Audience Analysis

The first major trend, being led from arguably the most competitive sponsorship landscape in the world, is the ever-increasing expectations from brands that rights holders have an accurate and genuine understanding of their own audience.

Now, more than ever, brands need to drive business outcomes. It is no longer about coming to the table with a compelling sponsorship proposition or well-designed proposal.

Big audience numbers are simply not that attractive anymore. What is expected is a deeper understanding of the audience, irrespective of size, and evidence to show that they will actively engage with brand messages and activations.

For rights holders, this means understanding fan’s (or customer’s) age, location, interests, spending patterns, purchasing history, attendance history, and so much more.

2. New Job Titles

As somewhat of a by-product of understanding audiences, new titles such as Strategy Director and Digital Transformation Lead/Director have been emerging rapidly.

We are seeing the solidifying of digital-first throughout North America and APAC as rights holder’s, across the UK and Europe, have begun to recognise the need to be more informed about their fans and customers.

Although already strong in the UK and Europe, the quality vs quantity debate will become more prevalent across the globe when reviewing the workforce against expected objectives or outcomes. Focussing time, energy, and budget on understanding the behaviours of their audience, that can then be used as commercial intelligence, is where we will see growth for the next few years.

North America

3. Cause-Related Campaigns

A noticeable shift in the North American sponsorship landscape is the growth of cause-related marketing. A great, and terribly humbling, example of this is the response to global protests over the death of Georg Floyd and the Black Lives Matter movement.

We saw this a few years ago with the WNBA’s Minnesota Lynx printing warm-up shirts printed with ‘Black Lives Matter’ and ‘Change Starts With Us’, and more recently NASCAR banning the use of the Confederate flag.

We are now, however, seeing this go global.

We’ve seen Manchester City, Arsenal, and every other Premier League team, in their first match back, placing ‘Black Lives Matter’ over the nameplates on player’s shirts. This suggests that it will be nearly impossible for brands and rights holders to not address their position and how they are approaching the conversation. In fact, staying silent is being interpreted by the market as actively opting out of the cause.

4. Push Towards Performance-Based Sponsorship Models Gaining Momentum

Whilst this is not a new concept, and we have talked about it in the past, we are starting to see it more and more.

A recent example is Nike replacing New Balance as Liverpool’s official kit supplier which increases royalties, based on the sale of licensed merchandise, with further cash bonuses tied to on-field performance.

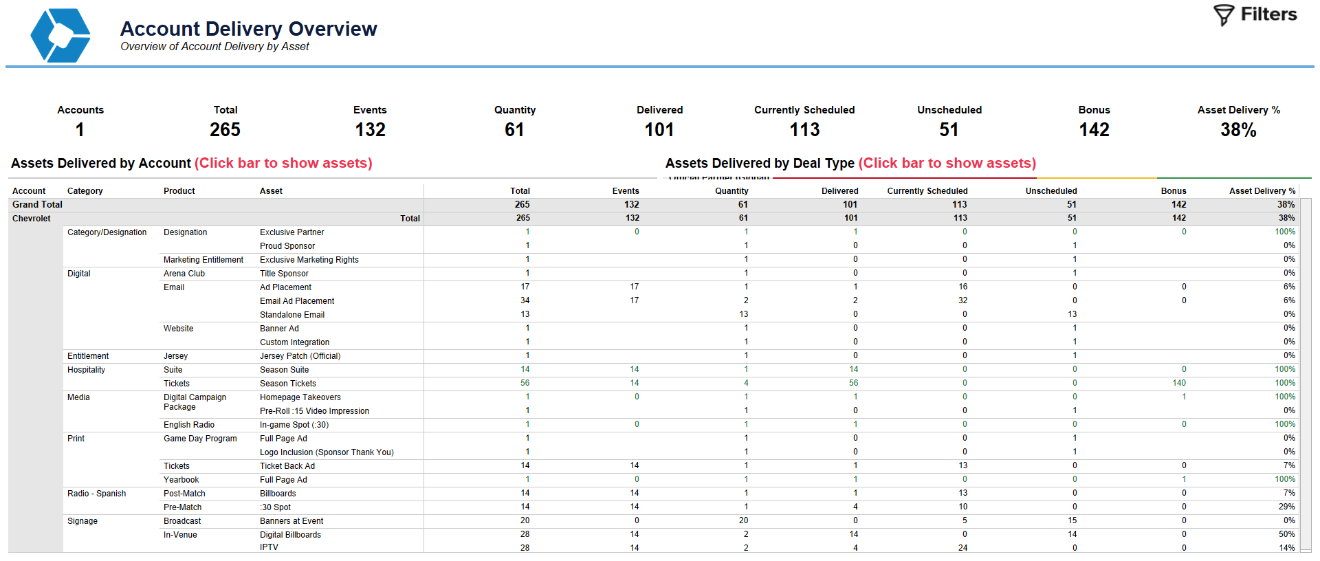

With real dollars being attributed towards these types of outcomes, it is critical that both brands and rights holders alike have a very clear way of tracking success. While larger brands tend to have the resources to track and measure these incentives in a variety of different ways, what is a bit more unclear, is how smaller brands, looking to replicate some of these modules, will be able to do so.

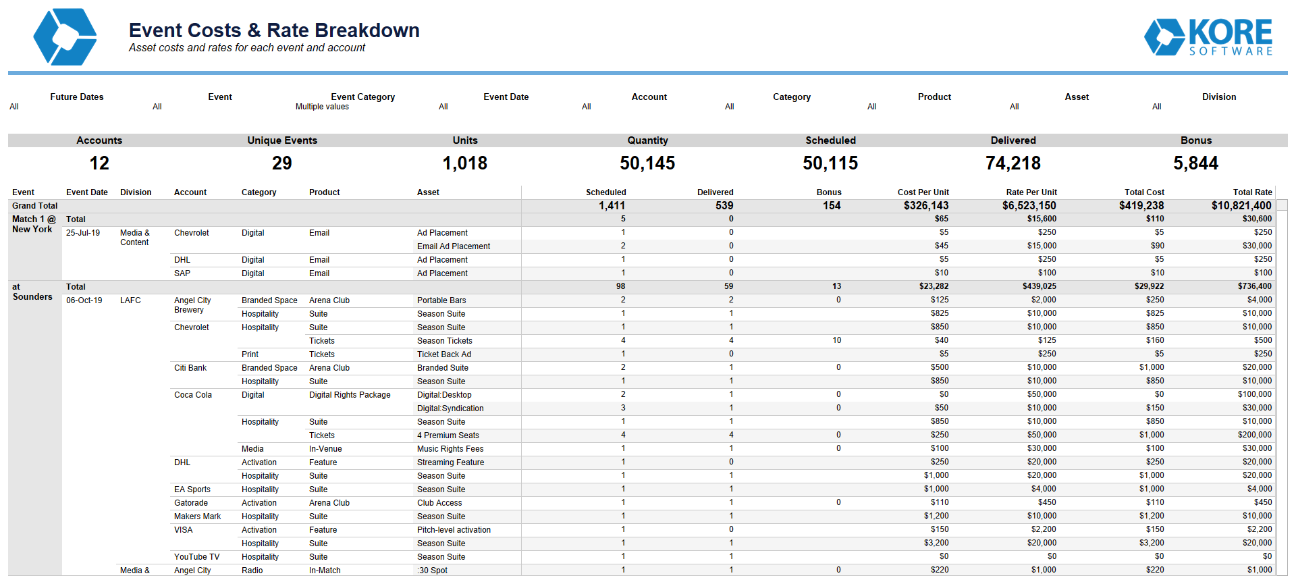

Clearly identifying the incentives, data associated with those deals, how they will be tracked & measured, and reported back to both parties, is something we’ve seen here at KORE as becoming more and more critical.

APAC

5. Re-purposing Assets

With COVID-related restrictions forcing changes to various categories of assets, literally every property in sponsorship has resorted to re-purposing assets, creative, activation builds, and a whole lot more.

Flexible strategy and adaptation of whatever was originally planned has been the cornerstone of thousands keeping their jobs and allowing branded messages to remain part of B2C efforts.

The impending challenge for rights holders, brands, and agencies will be deciding on when to return to normal … or whether that even actually happens.

In Australia and New Zealand, sport has resumed, and small crowds are even growing as restrictions continue to ease. At some point, in Australia, we will get back to capacity crowds (New Zealand already is), busy concourses, and fun-filled activations out the front of stadiums. However, that still takes time, effort, and resources to create and produce. The question we need to answer is, “When do we start planning for this?”

6. Lead times getting smaller

As something of a by-product of the workforce getting smaller and the greater need to respond to cultural and environmental trends, the lead time from creating an idea in a meeting room to execution, and seeing it come to life, is getting shorter.

Brands and agencies are seeing amazing campaigns turned around is less than two weeks which speaks to the ability of brainstorming, collecting data, and producing quality work the first time around.

The same expectation will soon be expected of rights holders as they welcome back staff. Inefficient WIP’s, copying-and-pasting the same activations, or basic campaigns will not cut it anymore. Like their counterparts, the need to develop ideas and execute the builds, quickly and efficiently, while still at a high standard, will be increasingly important for many rights holders.

The Move Towards Better

While COVID-19 has been devastating for the sports industry, one positive is the effect it has had on the status quo. It has forced both brands and rights holders to rethink how they execute sponsorships.

No longer can the industry just move from season to season, doing the same things, and shunning innovation and change. The current environment has forced creativity, and in many cases, stronger and closer relationships between brands and rights holders. There are many great examples of how approaches have changed, and the trends emerging, and hopefully those positive approaches will remain as we emerge from COVID-19 because it will make the sponsorship industry, in all markets, stronger.

KORE is the global leader in engagement marketing solutions, serving more than 200 professional teams and 850+ sports and entertainment properties worldwide, providing practical tools and services to harness customer data, facilitate sponsorship sales and activation, and create actionable insights.