Trends and Insights from SEAT 2019

Last week I had the chance to attend my 9th SEAT Conference (or 11th, if you count the 2 I attended in London). KORE has been the lead sponsor for the Data, BI, and CRM track at SEAT since 2015 and it’s always a great event for us to catch up with many of our customers who work in analytics roles and learn from our industry peers.

There were too many sessions, case studies, and side conversations going on last week to possibly keep track of all the insights and tactics discussed, but here are a few that really stuck with me:

1. Take Care of Yourself

I’m starting with one that seems off-topic, but the more it was discussed in multiple sessions, the more relevant and impactful it became. Right out of the gate there was a focus led by Jesper Nyholm, CEO of 7peaks, and echoed by several others, around the importance of health, sleep, and general self-care, both physical and mental.

The sports industry likes to take pride in how hard we work, how many events we’re at, how lean our departments are, and how much we still find a way to accomplish. However, this can take a significant toll on us as people. This conference really emphasizes community, so spending time reminding everyone that we’re not super-human and need to prioritize our own well being alongside our work was an important message.

Health & Wellbeing at #seatdaytona @SEATconference Please help us promote this topic by sharing the #peakingpower from your team/venue/organization. How are you converting sport knowledge to healthy empowerment? pic.twitter.com/JxxPj00xF1

— Nyholmdk (@Nyholmdk) July 15, 2019

2. BI’s Expanded Role in Digital

There are some data sources that everyone is more used to working with such as ticket sales, sponsorship, point of sale, and email to name a few. More and more though, it’s the digital and social platforms such as Google Analytics, Omniture, Facebook, Twitter, and Instagram that are impacting so much of the day to day business across multiple departments. Our digital teams are used to living in these systems, but now the key is breaking down that new digital silo and integrating those feeds and insights into the rest of the organization’s data ecosystem.

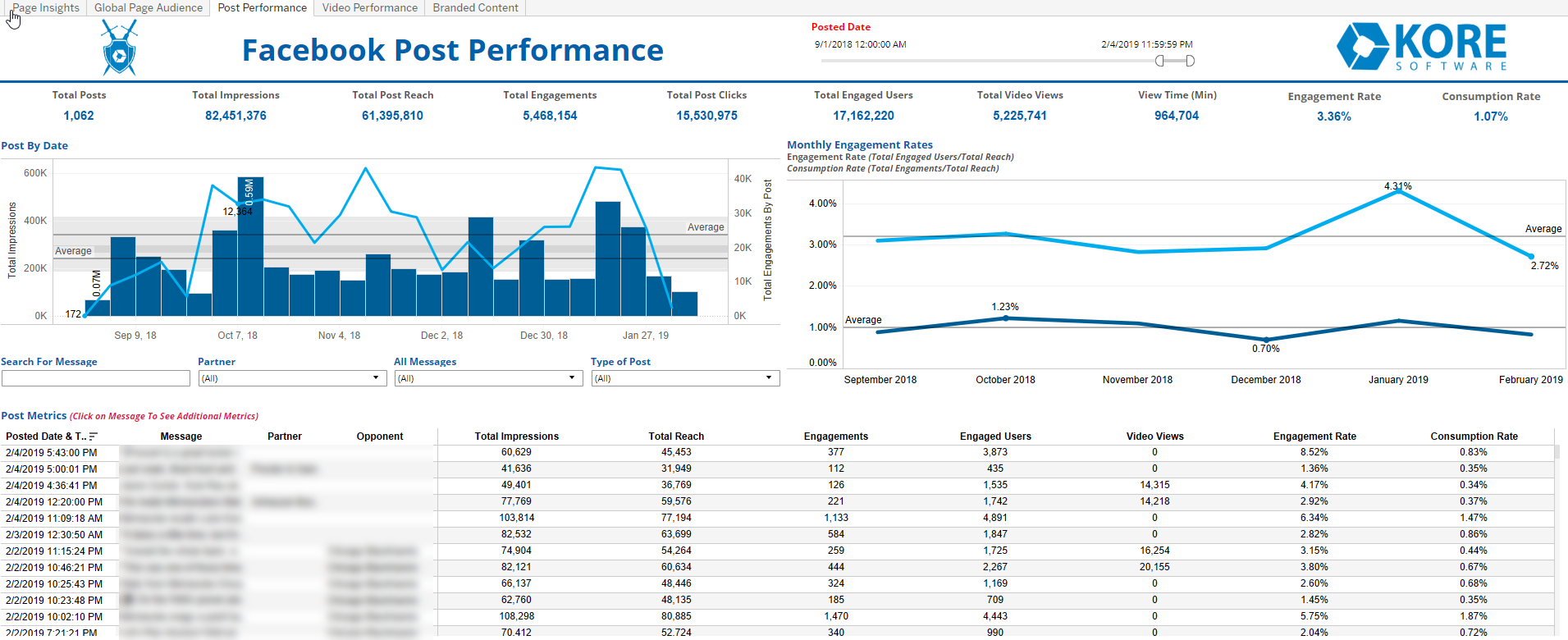

Doing this opens up a tremendous amount of opportunity. In our session “The Role of BI in Digital and Social Analytics”, we dug into this topic through case studies with the Minnesota Wild, San Antonio Spurs, and Facebook. Both the Wild and Spurs now have social and digital feeds integrated into their data warehouse for more accurate revenue attribution reports, tracking the value of partner branded content, and providing rich feedback to their creative teams to learn what drives engagement across different subsets of the fan base. The Spurs have also dug deep into aligning content across social channels with different fan personas. Finally Facebook showed us how repeat visitors and longer video consumption drove greater reach for organic content, which also gives the analyst team important new metrics to monitor.

Keep an eye out here in the coming weeks for a deeper-dive tip sheet from this session!

3. Don’t Just Integrate Data, Integrate Staff

Bjorn Kadlec from the Minnesota Wild said it best…

“You don’t want to keep 12 data nerds locked down in the basement.” Funny take on the importance of making sure BI staff are well integrated into the organization. #seatdaytona pic.twitter.com/HtEj4dSI6c

— Russell Scibetti (@rscibetti) July 16, 2019

Business intelligence is as much about communication as it is analysis. The best analysts in the world cannot help your organization if either they cannot communicate their insights or if the organization isn’t structured in a way where people can and will listen.

I loved this subsequent response to Bjorn’s comment by Amanda Cifu at the Florida Panthers:

Our #FlaPanthers BI team is right in the mix of the open office floor. I love sitting next to the “nerds” 😂👏🏼 https://t.co/FNcOs6OMn9

— Amanda Cifu (@AmandaCfew) July 17, 2019

That’s the way to do it. The department itself can be centralized (and I do believe that’s the best model for the org chart – others may disagree, but we can save that debate for a future post), but even if the BI resources tie up to one department, the staff can be collocated into various parts of the organization to stay well connected to the day to day business and their main functional priorities.

4. Design and Accessibility Drives Results

I thought the session led by Danielle Brown of the Oklahoma City Thunder, Bobbie Walker of the Utah Jazz, and Jimmy Steinmetz of Interworks was instantly actionable. We are all in the data visualization business – we need these tools to help the data come to life in a way that our end users can understand. As a result, any improvement we can make in how reports are designed can lead to more adoption and ultimately better decision making through data.

Danielle showed how taking a self-service approach to key dashboards can empower staff to answer their own questions, drive organizational curiosity, and result in deeper insights being shared with current and prospective partners. Bobbie showed how the Jazz have made key dashboards visible to stakeholders on screens across the entire office to drive transparency and adoption. Finally, Jimmy went through a great checklist on how to take a seemingly finished dashboard and with a few simple tweaks, make the KPIs leap off the screen. Here’s the checklist he used to guide this design improvement process:

Great UI design checklist for Tableau (or any viz tool) dashboard design by @interworks. #seatdaytona #dataviz pic.twitter.com/vgoIqNDT5G

— Russell Scibetti (@rscibetti) July 16, 2019

5. Process Optimization Never Stops

The first full day ended with closed-door round table discussions, a staple of SEAT with open, peer-to-peer collaboration around any number of topics. My particular table ended up digging into a number of challenges around lead qualification, sales psychology, CRM workflows, and more, but if I had to connect it all to one main theme it would be that we still have many ways we can continue to optimize our sales process.

There are many internal processes, interconnected systems, and data points that all need to be aligned to truly maximize our investment in these platforms. Something as simple as easier objection tracking, better timing on lead distribution, or workflows that make sure data appears in the right location can have a major impact on performance.

Bonus:

Here are some final thoughts and footnotes…

Big points to Jeff Douglas from Levy who managed to use Harry Potter, Severus Snape, and the Dark Arts in a fun metaphor for the balance between institutional knowledge and analytics.

I never expected to get a Harry Potter-themed metaphor in an analytics presentation at #SEATDaytona, but I love it! #darkarts #snape pic.twitter.com/rjzxSM8UyG

— Russell Scibetti (@rscibetti) July 16, 2019

There was an interesting dialogue between Paul Greenberg and Jonathan Becher on the use of the term customer in sports. While standard in most other industries, it implies a transaction and we have many fans that either don’t transact or maybe more importantly, don’t want to think of being a season ticket member as a transaction.

Interesting discussion on if the term customer implies too much of a financial/transactional relationship. It’s not inherently negative, it does imply a relationship, but in sports we also have the option to use fan, attendee or member. #seatdaytona #sportsbiz pic.twitter.com/Xdxb0tpaFN

— Russell Scibetti (@rscibetti) July 15, 2019

Turns out Daytona, Florida in July is a “little” hot but it didn’t stop folks from enjoying some hot laps around the racetrack to start the conference. I think Lenny Goh from Tradable Bits summed it up best with his take on the SEAT 2019 logo:

Who else didn’t pack enough shirts? ☀️ 😅 #seatdaytona #sweatdaytona pic.twitter.com/WoVUbYBt9h

— Lenny Goh (@lennygoh) July 16, 2019

We’ll see you at SEAT 2020, and thanks again to my great panelists below: Rosina Lanson (Facebook), Bjorn Kadlec (Minnesota Wild) and Jordan Kolosey (Sports Sports & Entertainment).

KORE is the global leader in engagement marketing solutions, serving more than 200 professional teams and 850+ sports and entertainment properties worldwide, providing practical tools and services to harness customer data, facilitate sponsorship sales and activation, and create actionable insights.