This past May, the NFL opened the opportunity for betting companies to sponsor and partner with football teams. Casino partners have been allowed since late 2018 but this is the first official move towards allowing betting partners. The caveat here is that only those teams that reside in states where sports gambling is legal can partner with a betting company.

Earlier this month, the Denver Broncos made strides by becoming the first team to announce a partnership: a multi-year deal with FanDuel as “an official sports betting partner and an official daily fantasy partner.” In this partnership, FanDuel will now have access to Broncos brand marks and logos to use across their platforms in Colorado. Considering sports gambling only became legal and active in Colorado in May, this is a huge and fast first-step in tapping the local sports gambling market. In addition to the deal with the Broncos, FanDuel has partnered with multiple local casinos across Colorado since the gambling legislation was passed earlier this year, solidifying their position as a leading betting outlet in the area.

Casino vs. Betting Partnerships

FanDuel is an official betting partner of the Broncos but this deal is not exclusive. The team has the opportunity to partner with other gambling companies to expand their gambling partnership category.

When we think about the gambling category, it is typically split into two: Casino and Betting.

- Casino partners are designed to introduce fans to a specific casino and its sportsbook

- Betting partners are designed to build awareness of the brand and mobile app, an area where FanDuel thrives

The benefit for teams is to expand their gambling category portfolio and reach different groups of fans and bettors than they may reach in other industry categories. This partnership could lead to an in-stadium sportsbook, for example, and attract the type of casual fans that only watch sports if their money is on the line.

Expanding Geographies

Sports gambling has only been legal outside Nevada since 2018 and the growth has been astronomical in the short history. Since legislation passed, 17 states have legalized sports gambling. The total known revenue kept by sportsbooks in 2018? A hefty $1.5 billion* per Legal Sports Report.

Keep your masks on, folks, because we’re just getting started.

Thank you to everyone who has placed a (legal) wager on sports since 2018: $21.9B has been wagered, with sportsbooks keeping $1.5 billion in revenue. In the 18 months of legal activity, sports gambling-related taxes collected by states exceeds $200 million.

The American Gaming Association (AGA) advocates states to adopt legislation in order to showcase the low-margin nature of sports gambling. The taxes generated vary state-by-state, but they come at low cost especially when mobile betting is an option. Let’s take New Jersey as an example – more than 81% of annual sports wagering revenue in the state came from online betting last year. Since 2018, New Jersey has generated over $60 million in tax revenue.

With Nevada’s 200+ commercial casinos and decades of legal sports wagering, there is no wonder they are the overall gambling market leader in this country and around the world. To be fair Nevada has a “first to market” advantage and a well-established reputation. The first ever ‘over/under’ spread was posted 80 years ago, meanwhile sports gambling was only legalized across the country less than three years ago. To put their advantage in perspective, since 2018 Nevada has generated 22% more sports gambling revenue than the second highest state. In addition, the Las Vegas Strip has consistently more than doubled any other market (Atlantic City coming in second) in commercial casino revenue. The Strip in 2019 has generated more casino revenue than the next three market leaders combined. And yet, after just two years of legal activity, New Jersey is surpassing Nevada as the leading state in terms of sports gambling revenue. Online and mobile access in New Jersey can be attributed to their success.

Between 2018 and 2019, sportsbooks across the country saw a combined increase in revenue of 177% and local governments saw tax revenue increase by 225%. There is an ethical component when discussing gambling which is a driving factor is state-by-state decision making on the legality. The AGA surveyed Americans about their thoughts on this and the results were astounding: Over the last two years, 88% of surveyed Americans consider gambling to be a fully acceptable form of entertainment. If sportsbooks are going to exist in stadiums, almost the same way Citi Field has a fully functioning Shake Shack, I would expect this number to climb even higher.

A Tale of Two States

Two states in particular have piqued my interest research; Colorado, especially considering how quickly they are expanding gambling, and Pennsylvania, who saw a remarkable expansion in the market over the last year.

Colorado

Personally, I have high expectations for the success of the FanDuel-Broncos partnership. While Colorado actually saw a 1% decline in overall commercial casino revenue between 2018 and 2019, I would expect that to change now that sports gambling has been introduced. Their largest area for gambling, Black Hawk, took responsibility of most of that decline. This is the same casino that struck a deal with FanDuel in May of this year, meaning they see the opportunity sports gambling provides and are betting on a new crop of bettors to frequent their casinos. There is a lot to look forward to in the coming years.

Pennsylvania

In the same 2018 to 2019 period, Pennsylvania saw a 4.1% increase in commercial gaming revenue, with only 12 locations compared to Colorado’s 33. A major reason casino-goers were increasing their participation at other table or electronic games can confidently be attributed to sports betting. Pennsylvania saw over $111 million in sports betting revenue in 2019, compared to less than $3 million in 2018 when it was still new. PA’s online sportsbooks did not open until half-way through 2019 but they still accounted for over 60% of sports wagers.

Let’s just think about that for a moment: Pennsylvania went from less than $3 million in 2018 to over $111 million in 2019, and online playbooks made up over 60% over that figure despite opening only halfway through the year. A 4,000%+ year over year increase in part of an industry does not sound too bad to me. Sports gambling only made up about 3.3% of the commercial casino’s revenue in 2019, showing how the low margins of sports gambling can result in new customers and a positive impact on the overall casino.

What’s Next?

With FanDuel’s two partnerships (Denver Broncos and Black Hawk Casinos) in Colorado, they’re creating a bridge for fans to experience a new form of entertainment, and also giving teams an opportunity to see new fans that clearly have an affinity for entertainment (i.e., gambling). According to the AGA, nearly half of American said they planned to visit a casino over the next year, some of which I’m sure are not day one sports fans but still enjoy the entertainment of gambling.

Commercial casinos still blow sports gambling out of the water when comparing revenue streams, but sports partnerships with both casino and betting partners is a rare win-win-win scenario. Looking back at Pennsylvania, the state credits sports gambling for contributing to more table game participation. While the percent of sports gambling revenue compared to the overall revenue of a commercial casino was only 1.5% in 2018, that percent has already doubled for 2019. When partnerships like the Broncos & FanDuel are created, they leave an opening for a casino to capitalize on new markets to tap into.

Where else are there passionate enough customers that wear the clothes of their local entertainment company? I have seen more Dolphins attire at Hard Rock Stadium than Hard Rock apparel at an actual Hard Rock casino.

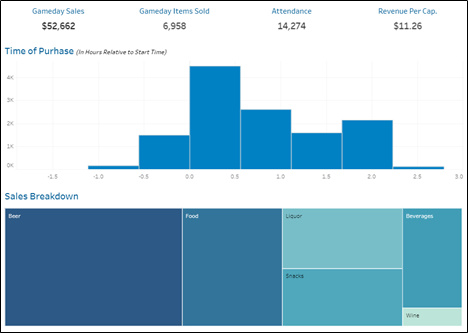

Since we love to aggregate data to generate interactive insights here at KORE, we put together the Tableau Public dashboard below so you can explore the metrics we were able to find through our research. Click here to view.