Congratulations to the Cincinnati Bengals and the Los Angeles Rams on winning their respective conferences and facing off in the Big Game on Sunday, February 13th. These two teams took very different routes to this point, so let’s see how they historically stack up against each other, both on and off the field:

| Team |  |  |

| Cumulative Social Media Followers | 11 million | 34 million |

| Social Fans Added This Season | 4.8 million | 3.4 million |

| Market Population | 2.3 million | 13.2 million |

| Average Age of Players | 25.6 years old | 25.5 years old |

| Teams’ Founding Year | 1967 | 1936 |

| Last “Big Game” appearance | 1989 | 2019 |

| Players in Top Jersey Sales | 5 weeks (either Joe Burrow or Ja’Marr Chase) | 0 weeks |

| Retired Uniform Numbers | 1 | 7 |

The Rams improved their team over the past 12 months through trades and free agency, meanwhile the Bengals have predominantly acquired their star power through the draft process. Both rosters are of similar age, but the Rams main characters have more experience in the NFL. This does not necessarily bode in favor of one over the other. According to The Action Network, the Rams only open as 4-point favorites, hinting at a very competitive matchup.

When comparing markets, historical impact on the game, and historical success, the Rams have a solid hold on these metrics. This season though, the Bengals young core have captured a national audience and give off “team of destiny” vibes. The Rams have been around much longer and have had more on-field success in recent decades, but the Big Game is no guarantee.

There are interesting differences among the players’ social media profiles. For example, Odell Beckham Jr, wide receiver for the Rams, has by far the most followers of any player not only in the Big Game but also among the entire NFL, with 22.1M. In contrast, Joe Burrow brought his total social following to about 3 million, 17th among NFL players. While “only” 17th in the league, Burrow shot up the social ranks this year, taking the top spot for the highest follower growth rate of any NFL player in the league at +484% this season. His social influence is noticeably impactful, as Burrow’s fan engagement rate is 4x the league average for players with at least 500k fans.

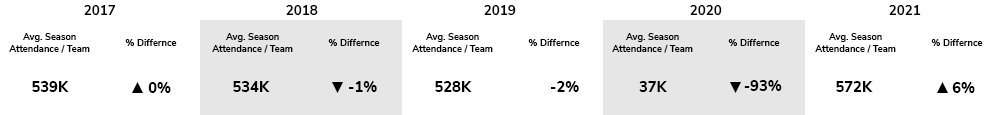

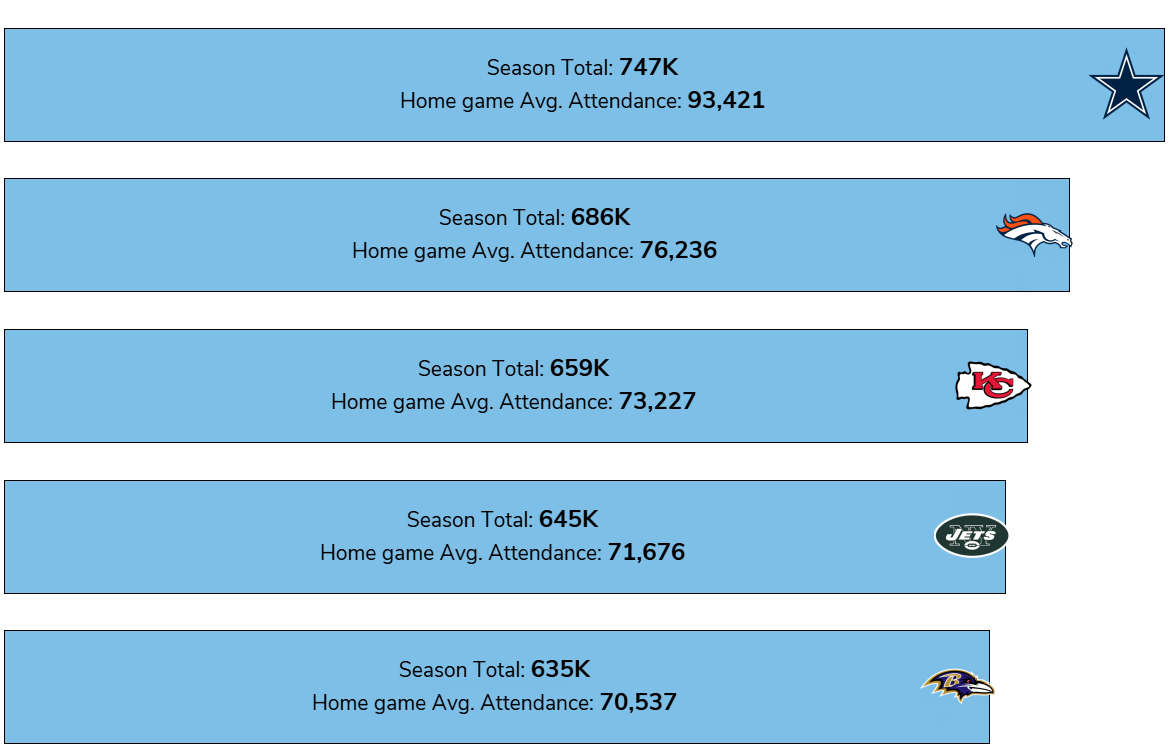

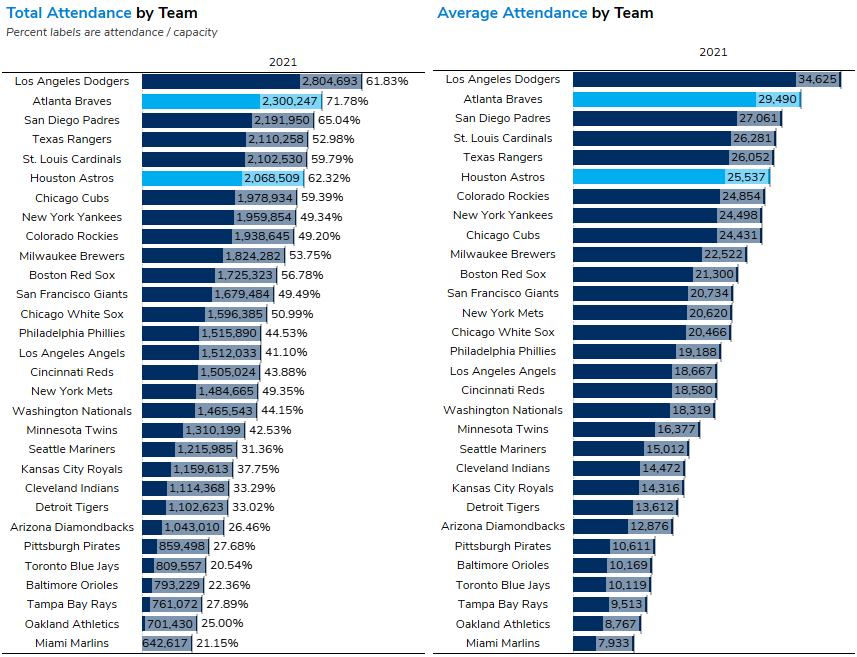

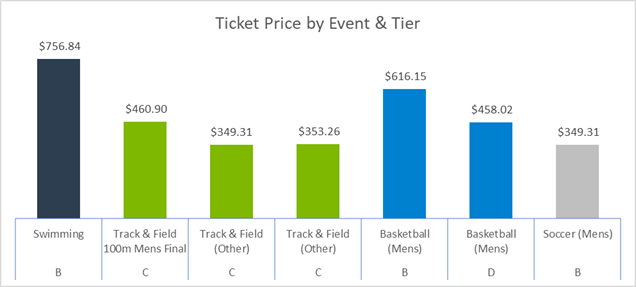

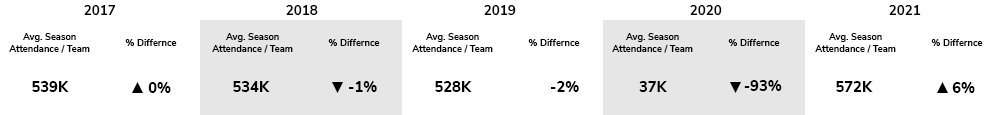

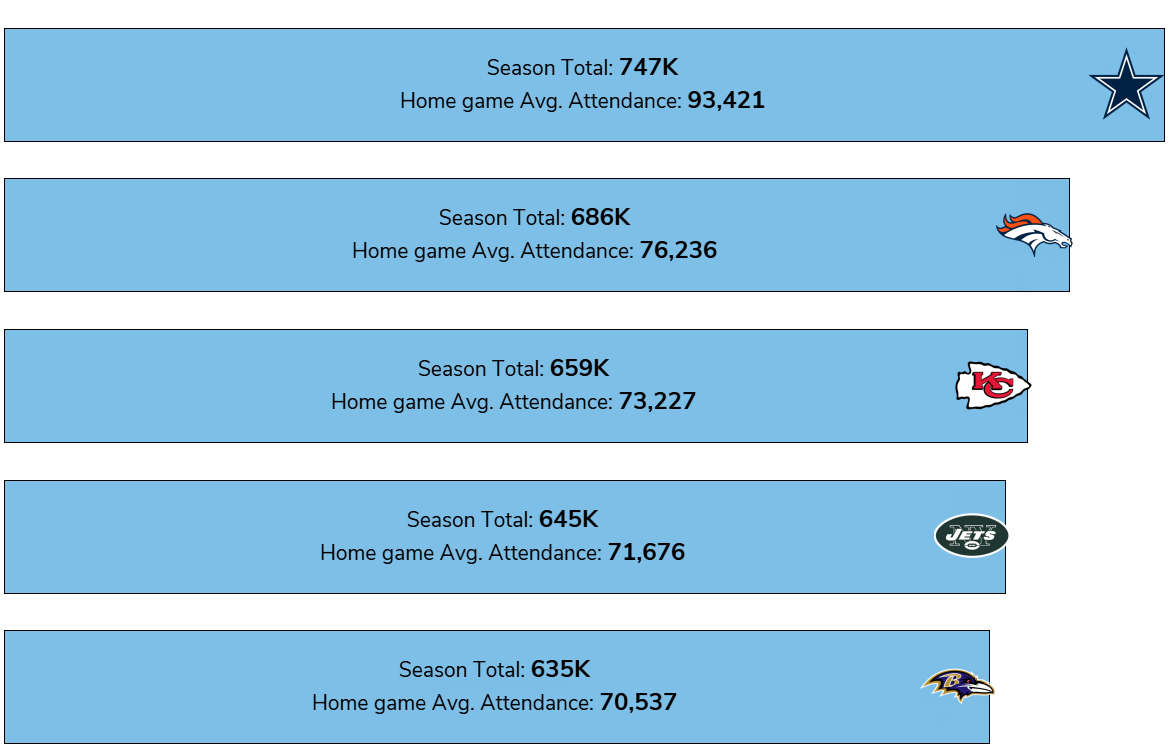

Attendance across the NFL this year reflected record numbers, regardless of the existence of a pandemic. On average, NFL teams hosted over half a million fans over their now-expanded 8 game schedule. This averages to just over 67k fans per game, or 95% of available capacity. This was a 6% increase compared to 2017 numbers.

Attendance numbers are rounded for visual purposes

The top 5 teams in terms of total attendance were an interesting mix. Original assumptions were based around local Covid-related restrictions, but the NFL season started as most of the population had received at least one dose of their vaccine. The top attended stadiums are split between the biggest markets or the better performing teams, coupled with some loyal fan bases like the Denver Broncos.

The 1980 NFL season finale holds the attendance record with 103,985 spectators, meanwhile the most watched championship game was in 2015 when 114.4 million viewers watched the New England Patriots beat the Seattle Seahawks. It’s important to recognize the 2021 numbers as impressive given the circumstances: last year’s matchup between the Tampa Bay Buccaneers and Kansas City Chiefs had limited capacity due to Covid-19 restrictions, so attendance was expected to be on the lower end of the spectrum. The game also posted a 15-year low for ratings with 96.4 million viewers but crushed it in streaming. According to “digital-only viewers” those numbers were up 65% year over year, to 5.7 million digital viewers per minute.

For as much heat traditional cable/television viewership gets as “being dead”, it isn’t going anywhere anytime soon. During this 2021 season, NFL games accounted for 91 out of the top 100 most watched television programs. Read that again. Football is dominant in the United States. To support this even further, an Ipsos Poll found that over half of Americans have some type of fandom towards the NFL, and no other major sport here in the U.S. cracked 50%.

The Big Game is unique, where the major networks take turns broadcasting the event. Referencing SportsPro media, starting in 2023 through 2034, ABC will air the Big Game twice, CBS will air it three times, Fox gets the honor four times, and NBC gets the game three times. The combination of these deals, plus amazon’s nearly-exclusive-streaming-deal, amounts to about $110 billion over that 12-year stretch.

The NFL showed their commitment to technology by engaging with Amazon in their broadcasting arrangements. Having a dedicated digital platform like Prime Video is surely an experiment for both parties; per the comparable deals, Amazon is paying the least but a specific premium on bringing the NFL to a new platform, as “the viewing on Prime Video has never been quantified by Amazon.” It is more of a strategic initiative than a proven concept.

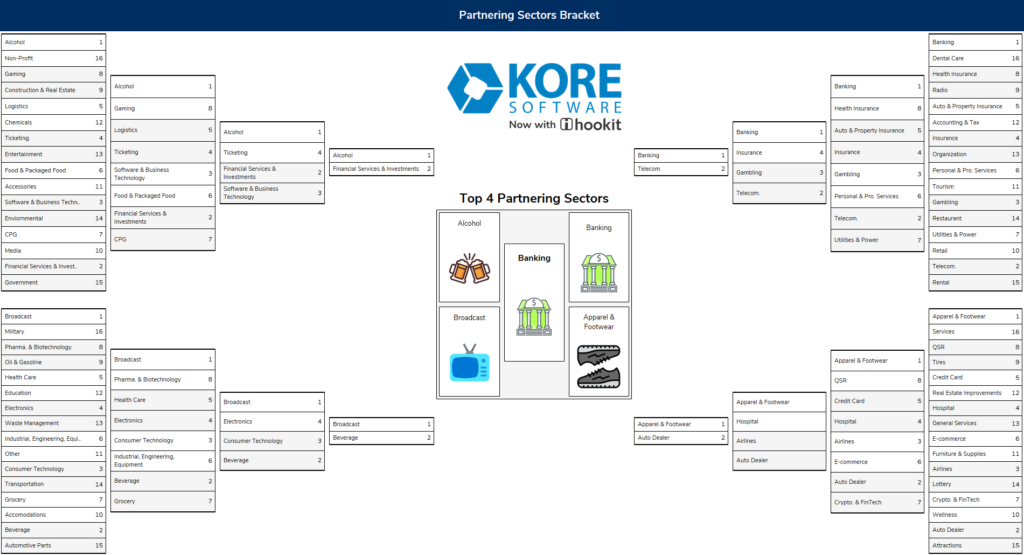

Referencing KORE’s Industry Leading Data Set, the NFL is a confirmed leading league in terms of including digital assets among their sponsorship deals. In 2018, KORE saw those digital assets (e.g., social media, website content, email) included in 53% of deals. Fast forwarding to 2021, these assets are included in 63% of deals. For comparison, baseball teams only included digital inventory in 26% of their deals in 2021, and basketball organizations have them included in 46% of deals.

Focusing on digital assets only, the NFL tends to value their website inventory more than other types of assets, with email marketing in a distant 2nd place. Commonly, this is allocated between banner ads and branded video content. As we focus on individual industries that are buying these assets, we see an interesting spike from the entertainment industry (e.g., betting partners) towards banner ads, and health care and insurance companies placing value on branded content.

Pepsi is a long-time partner with the Big Game, owning the naming rights of the half time show and its endless attempt to surpass what was done the year before. However, this upcoming game will be Pepsi’s last and the NFL plans to go to market to sell this deal, which might be the biggest piece of sponsorship news since Ted Lasso mentions Lynx Body spray even though LACOman spray is the official club sponsor of AFC Richmond (a major faux pas, even for a fictional team).

This year’s halftime show will showcase rap and R&B legends, including Dr. Dre, Snoop Dogg, Eminem, Mary J. Blige, and Kendrick Lamar. Per CNBC, the value of the halftime show has a wide range, anywhere from $25 million to $50 million. A valuation is tricky to place on this event, but at the same time very justifiable. Let’s explore:

NBC is the exclusive broadcasting partner for the Big Game in 2022. According to Reuters, companies are shelling out upwards of $6.5-7 million for a 30 second advertisement during the game. This is already an 18% premium compared to what CBS charged last year, indicating a bullish sentiment on how many people are estimated to tune in this year.

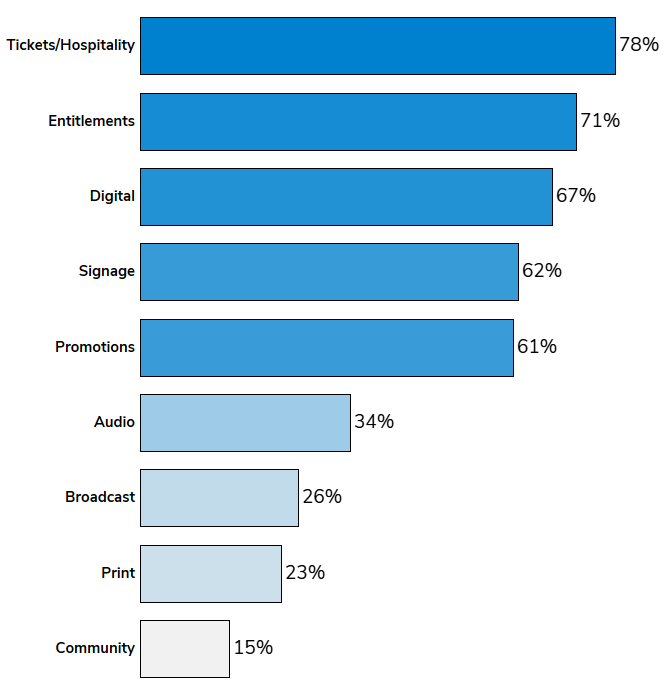

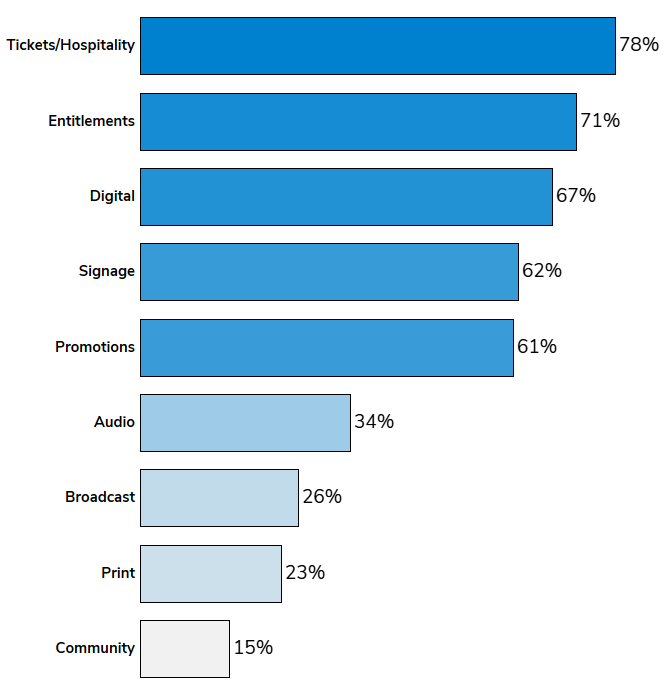

Sticking with Food & Beverage brands as an example, we’ll dive deeper into the sponsorship portfolio. F&B brands typically include the following assets in their sponsorship deals when partnering with American football teams: Tickets/Hospitality, Entitlements (e.g., official partners), and Digital.

As important as entitlement assets are to help stake a claim, hospitality is very interesting this year. As we remember from the 2021 Super Bowl, the game had limited capacity due to Covid restrictions. With restrictions likely easing for this game, we can see the emergence of hospitality events around the stadium coming back. The NFL is its own case study here, this December the league owners “voted grow its stake in On Location Events from 13.5% to nearly 45%.” On Location enhances the gameday experience by immersing fans directly into live events beyond traditional attendance. The NFL knows all too well the importance of a heightened experience, and there is no doubt the Big Game will bring about top engagement numbers.

With Pepsi in the last year of their contract, who might be the next presenter of the Big Game halftime show? Here are some of our favorite predictions with some rationale:

- Verizon – well established sponsor of the league and individual teams

- FTX – They are spending hundreds of millions on sponsorship already

- Netflix – A virtually (no pun intended) endless amount of stardom and content can bring the half time show to new heights

- Caesars – Already a stadium sponsor in New Orleans, trying to expand their betting footprint, especially online

- State Farm

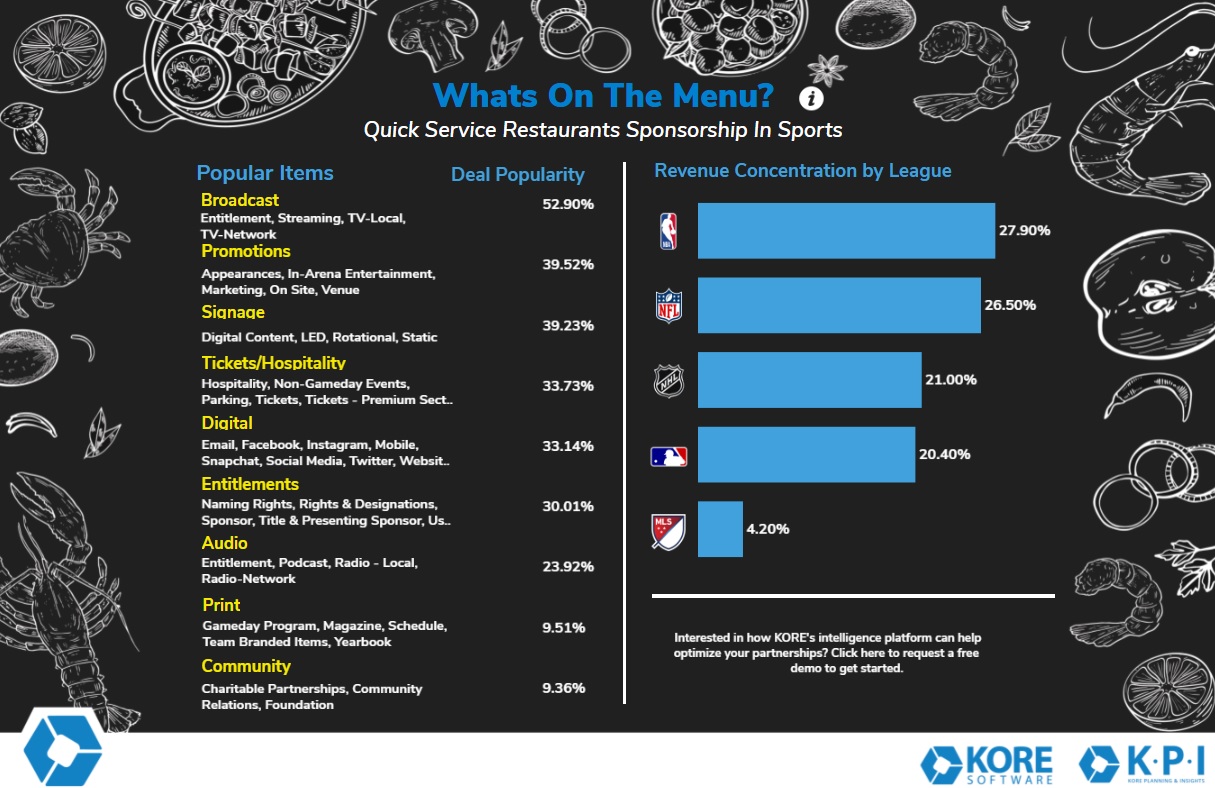

- Wendy’s – one of the top spenders on sports sponsorship in one of the most emerging categories (QSR)

Best of luck to both the Bengals and the Rams, and congratulations to these respective fan bases. Enjoy the moment.

Sources:

Age of players’ source

S. Metro Statistical Areas

Fanatics jersey sales

Retired uniform numbers

Miami Heat announces FTX as venue naming rights partner

Caesars Sponsorship in New Orleans

QSR sponsorship spend